We have previously talked about whether income and losses from cryptocurrencies are taxed. Today we will find out how to act if you decide to cash out income from the sale or exchange of virtual currency. First, let’s figure out the legitimate side of the issue and consider the IRS instructions for form 8949. It should be learned by anyone who submits a declaration about a capital gain or loss with the IRS.

Until 2012, taxpayers deriving income from trade transactions filled out only Form Schedule D. In 2014, the Internal Revenue Service (IRS) considered the status of cryptocurrency, equating it to capital assets and stocks. In this way, a special capital gains IRS form 8949 was developed, which obliges taxpayers to report financial gains and losses that arise in the process of trading virtual currency.

IRS form 8949: what is it, when, and who needs to fill it out?

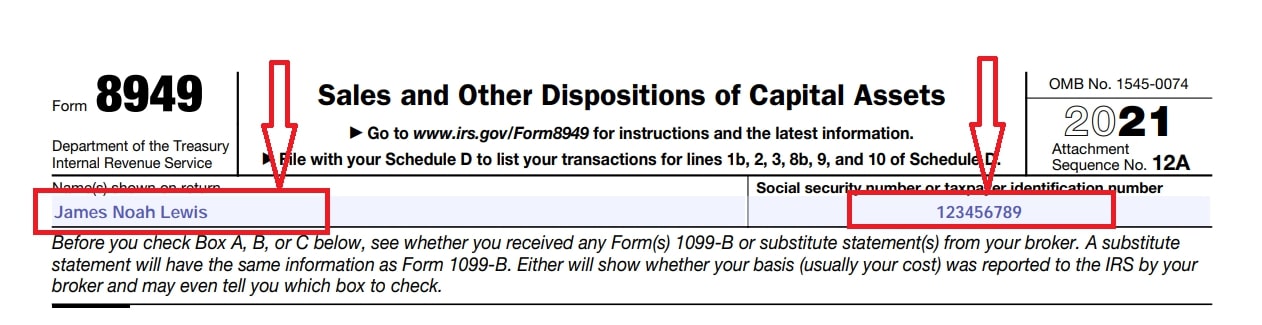

The name of the capital gains IRS form 8949 is “Sales and other dispositions of capital assets”.

This is a form for reporting sales and exchanges of capital assets. These include stocks, bonds, cryptocurrencies, collectibles and art, rare coins, and real estate. In fact, these are tangible assets that can be touched.

Form 8949 is a supplement to Schedule D of form 1040 of the individual income tax return. It is filled out first of all since it deciphers Form 1099-B on the cost base of purchase and sale transactions and reflects complete information about the financial transactions made.

A complete list of tax return forms is provided in the IRS instructions for form 8949.

For cryptographic reporting, the following forms are most often required:

- IRS 8949,

- Schedule D,

- Schedule 1,

- Schedule C,

- Form 1040 (Individual Tax Return).

Form 8949 is used by both individual taxpayers and corporations, partners, and trusts. You can ask yourself: Do I need to file Form 8949?

Important! You do not need to file Form 8949 if your income has not been realized.

You can read more about the nuances of cryptocurrency taxation in this article.

Each realized transaction is a taxable event. Therefore, each financial gain or loss must be reported in the declaration. Professional traders usually fill out a form for hundreds and even thousands of positions, detailing each transaction.

It is worth noting that form 8949 is used not only in the United States but also in other countries for taxing citizens.

Features of IRS form 8949

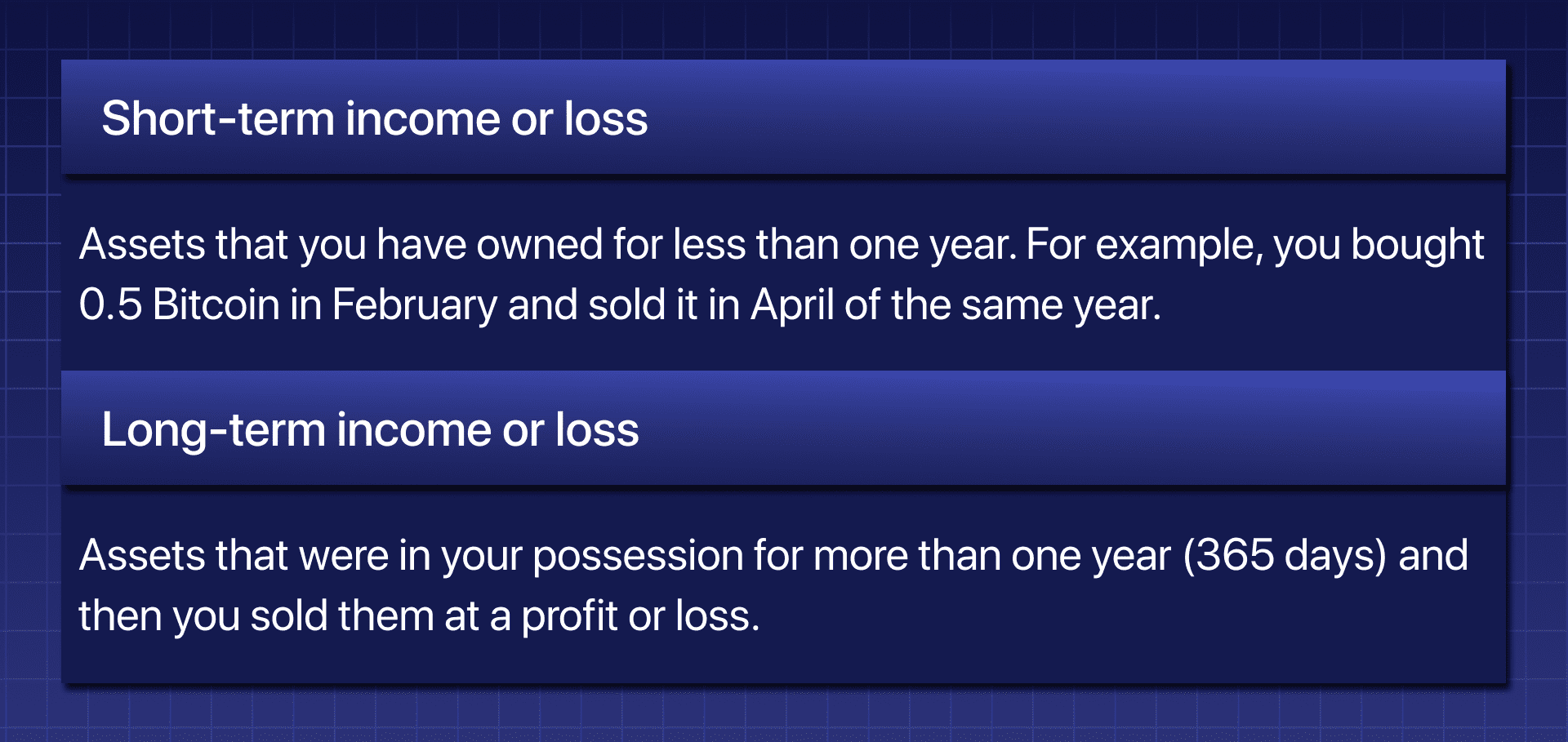

According to the holding period of the transaction, capital gains and losses are of two types — short-term and long-term.

According to the instructions of the IRS 8949 form has two pages. The first is given to fill out short-term profits, the second – for long-term.

Why is it important to fill out the declaration correctly?

Short-term and long-term sales are taxed at different rates.

As a rule, long-term incomes are subject to preferential tax at a lower rate. The exact rate depends on the tax category you are in. Therefore, holding your digital assets with unrealized gains for more than one year is beneficial.

If you have unrealized losses, the holding period is less important. Most often, traders file losses in the declaration to reduce their tax liabilities.

Step-by-step instructions for filling out IRS form 8949

The IRS provides a sample of form 8949 on its website. It can be printed and filled out online.

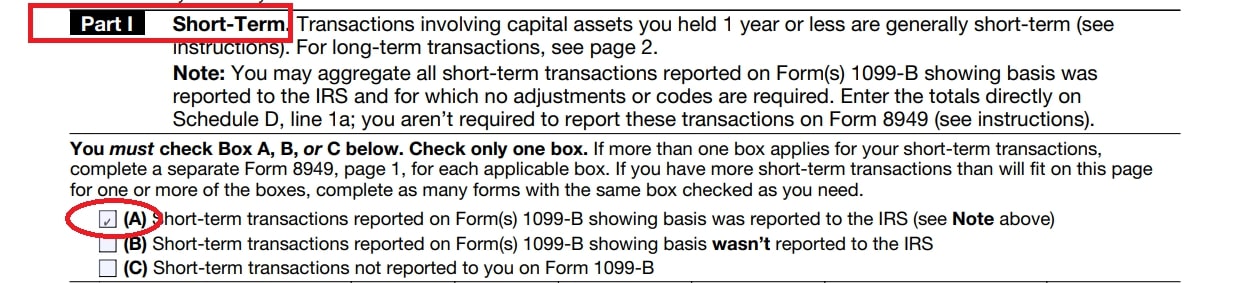

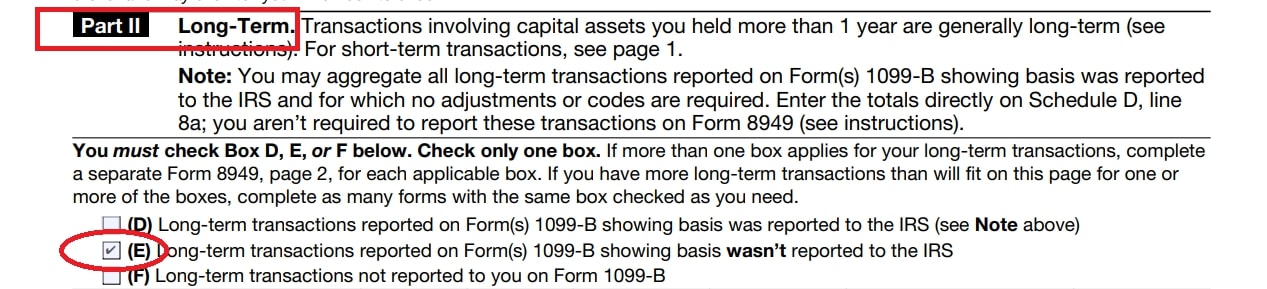

Each part of the form is practically identical. They have three types of categories, indicated by a flag at the beginning of each section, for short-term and long-term transactions. Before proceeding to fill out, you need to select the appropriate reporting category and mark it with a flag on the sheet, as was done in the example of filling out form 8949.

For Part, I (short-term), check boxes A, B, or C:

For Part II (long-term), check boxes D, E, or F:

Because you may have transactions that fall into more than one of the above categories, you will need to complete multiple submission forms.

If your brokerage firm has reported all of your capital gains and losses for the year on Form 1099-B on the correct basis and you do not need to enter any adjustments (column g) or any codes (column f), you do not need to file capital gains IRS form 8949. You can simply enter the totals in Schedule D.

For each transaction, you will need the following information:

- name and quantity of the asset;

- date of acquisition of the asset;

- date of sale or exchange of the asset;

- sale price according to market value;

- the current price of the asset according to the market value.

How to fill in the form?

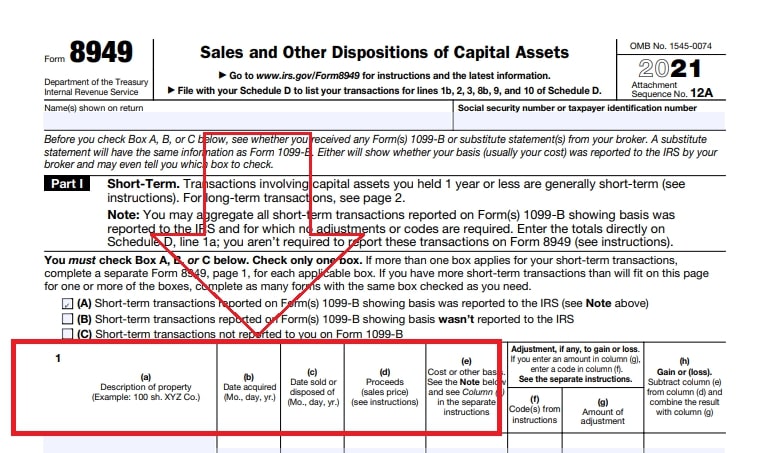

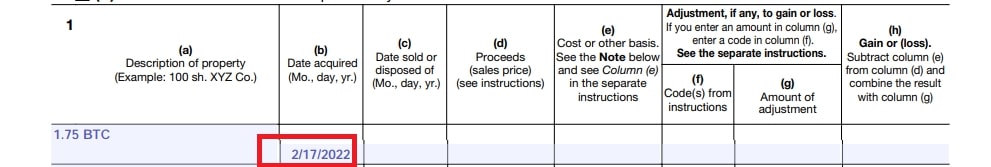

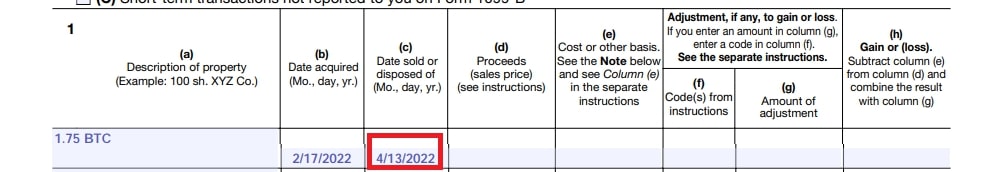

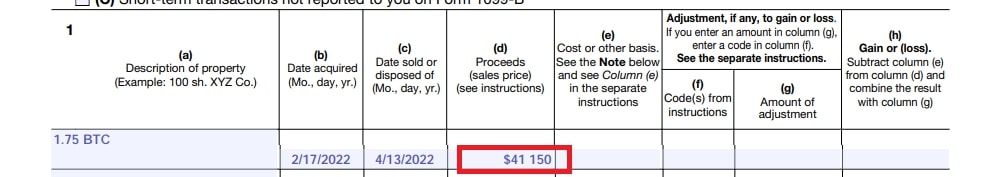

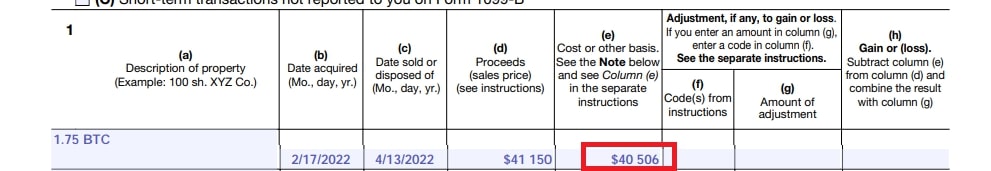

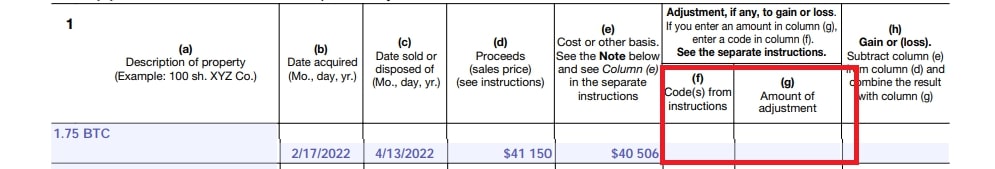

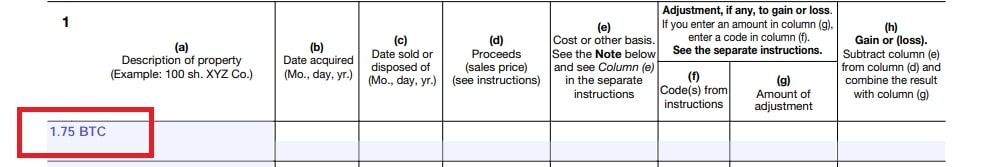

In the form, this information is presented in columns A-E as follows:

Before filling out the form, enter your first and last name, as well as your taxpayer identification number (TIN) in the header.

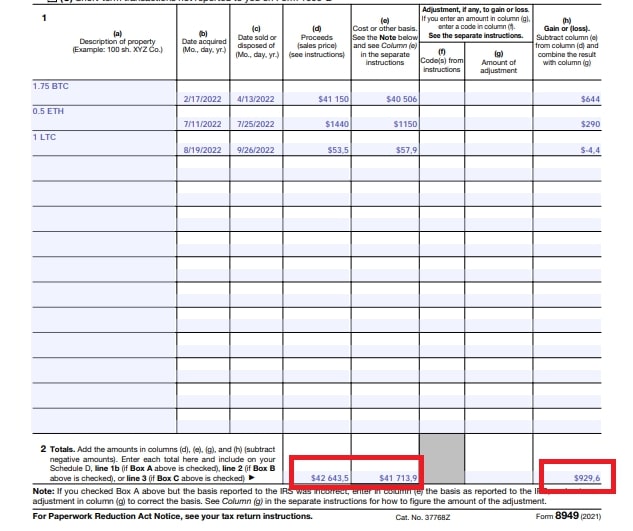

Next, we proceed to fill in the columns of the form in accordance with the current calculations and details of each transaction:

Column A: Quantity and name of an asset sold, exchanged, or spent.

Column B: Date of acquisition of the asset (MM/DD/YYYY).

Column C: Date of sale or exchange of the asset (MM/DD/YYYY).

Column D: Price of the asset at the time of sale or exchange in US dollars.

Column E: The original USD price of the digital asset you sold, traded, or spent.

Columns F and G: Income or loss adjustment codes. Most of the time they are not filled out.

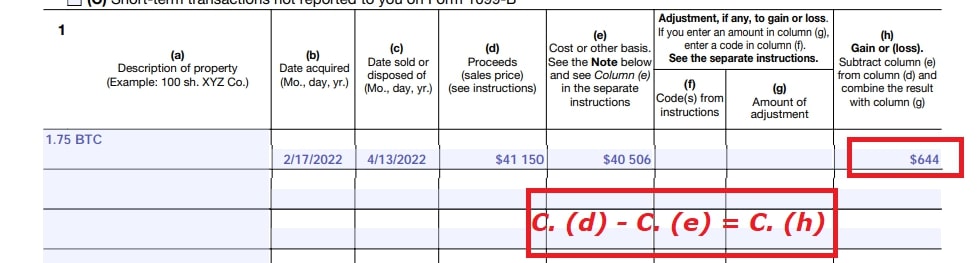

Column H: Income or loss. Calculated by subtracting column (e) from column (d).

Your totals should then be included in the summary fields located at the bottom of the form.

Follow the same steps according to the instructions of Form 8949 Part I for all of your long-term transactions that fall under one of the reporting categories.

In conclusion

Filling out Form 8949 is not difficult if you follow the instructions. Both beginner traders and experienced crypto investors will cope with this. But if you want to submit information about all transactions, and, as we have already said, there may be hundreds or thousands of them, doing it manually is not so easy.

For these purposes, professional traders use various financial utilities and programs that import information from wallets and exchanges, displaying it in an acceptable form and even generating data directly into the form.

However, you should definitely keep a record of all your investment transactions yourself, as this will facilitate the work of tax reporting and protect against unpleasant situations in the future.