Peer-to-peer (P2P) payment apps are a great tool for fast and secure online payments. One of those is PayPal. It’s a convenient and functional electronic payment system and you most probably have heard about it. A recognizable app icon can be found on the websites of well-known marketplaces. People around the world use PayPal to pay for goods and services online.

PayPal has developed a flexible system of financial interaction between relatives and friends. It’s a very practical addition, eg, when you need to split the bill in a restaurant. The main question that we’ll explore today is: does PayPal report to the IRS on relatives and friends?

Are PayPal transactions taxed?

Under Section 6050W of the Internal Revenue Code in the US, all payment institutions, that are subject to the jurisdiction of a State, including PayPal, are required to report commercial transactions. So, if a payment for the purchase of a product or service was transferred through the application, PayPal must report them to the IRS.

What is Form-1099 K?

According to the Internal Revenue Code, Form 1099-K is valid in the US. It’s designed to allow electronic payment services and other platforms to report on the marching income that taxpayers would receive during the transaction using their resources. Those are also received by users of socials if they use the services of shops on websites.

PayPal is required to provide Form 1099-K to users because it’s considered a third-party seller. This rule applies if the client exceeds the following limits in a calendar year:

- a total cash payments volume from sales exceeded $20,000;

- a total number of payment transactions for goods and services exceeded 200.

Let’s analyze the case.

During 2021 you made transactions for $27 000 on PayPal. At the same time, you made only 175 transactions processed by PayPal. In this situation, you won’t receive tax form 1099-K, as you need to enter income data in your statement.

If you use PayPal as a business payment service, you should create a corporate account. It’ll let you track commercial transactions and maintain audit documentation.

What is PayPal Friends And Family and how does it work?

PayPal Friends And Family (PPFF) is designed for non-commercial payments between family members and friends. This service allows you to send and receive funds for personal use.

PPFF is a great choice for sending gift cards or money to a friend, mother, etc. All you need are recipient’s email address in PayPal.

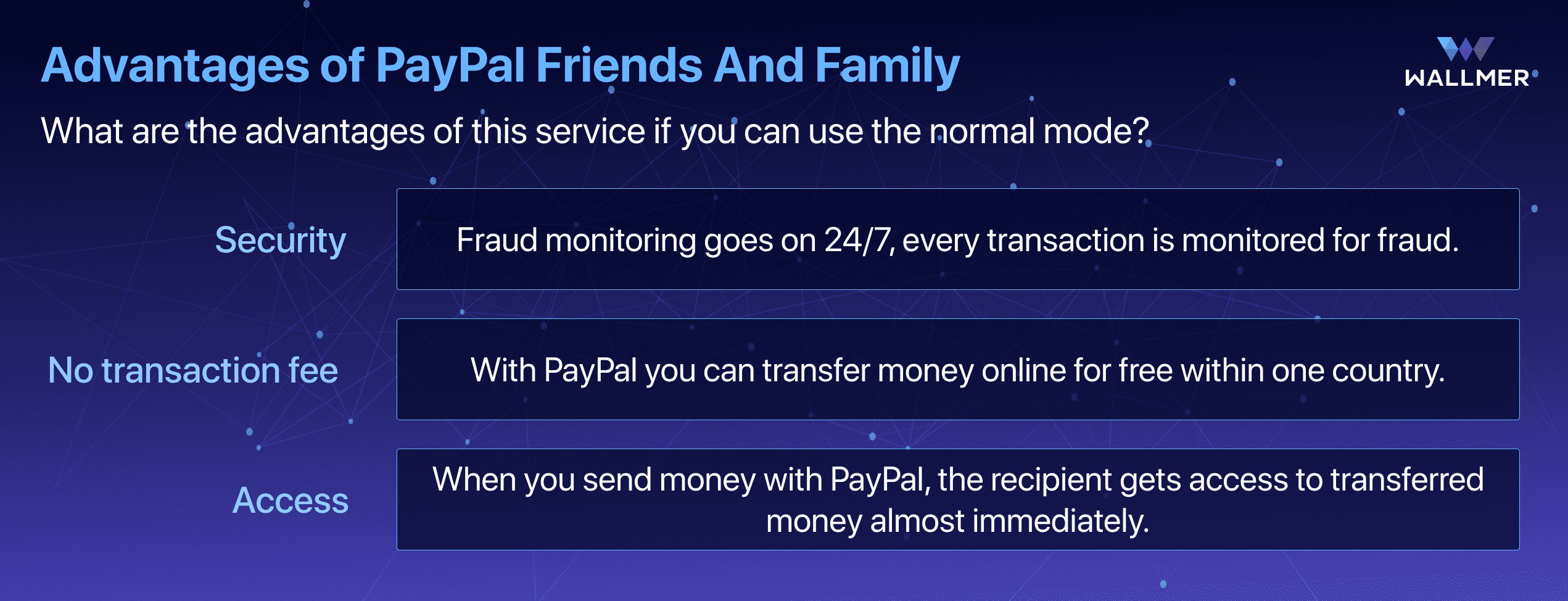

Advantages of PayPal Friends And Family

What are the advantages of this service if you can use the normal mode? There are several of them:

Is there a limit on PayPal Friends And Family?

One of the main advantages of PPFF is that there is no limit on sending money to your relative or friend. You can make as many transactions and send as much money to one person’s account as you deem fit.

However, there is one thing that we’ll inform you of after you read the next question.

Does PayPal report to the IRS about payments to friends and relatives?

Receiving or sending money to family and friends falls under the category of personal payment.

Therefore, the answer to the question “Does PayPal report to the IRS on friends and relatives” is brief — “No”.

However, PayPal closely monitors all transactions on the platform to comply with government financial regulations. Thus, it can determine if commercial users are using the PPFF option to avoid tax liabilities.

The point you should be aware of

Entrepreneurs who want to avoid paying taxes use simplified transfers between family members and friends. During the transaction, the entrepreneur must cover the fee that is charged to the buyer in the amount of 2.9% + 30 cents. Many stores offer customers to pay for goods using the option “Friends and Relatives”.

All transactions that exceed $600 within PayPal Friends And Family are submitted to the IRS for review.

It is worth noting that using PPFF to pay for goods or services is not the best option. This entails certain risks:

- Blocking of the entrepreneur’s account.

- Freezing of funds on the account until the circumstances are clarified.

- Fines and criminal liability for tax evasion.

PayPal operates under US law. When interacting with this payment system, you should understand that it keeps track of all transactions that you make on the platform.

It’s better to keep copies of your receipts if you receive any money through PayPal to avoid getting into trouble.

Conclusions

PayPal is a popular payment service that is used for personal transfers and commercial transactions. It reports the income of its users to the Tax Service if their activities are related to entrepreneurship.

Those who use the Friends and Relatives option for personal transfers are exempt from taxation. However, if PayPal considers a wallet transaction to be suspicious, it may submit a customer income statement to the IRS.

You should remember that PayPal strictly controls all transactions on the platform, so any payment fraud will be quickly discovered and punished.