If you invest in cryptocurrency, be prepared for both unrealized gains & losses. Even though most crypto investors try to calculate the result of the transaction several steps ahead, things don’t always go as expected. This is because at any moment the market value of a coin can change.

Until you make a sale transaction, all your cryptocurrencies exist only in digital form. It means they are not cashed out. At this stage, any change in the value of the cryptocurrency is determined as an unrealized gain or loss.

From today’s article you will learn:

- What is unrealized gain and loss?

- How are they calculated?

- Is capital gain tax charged on unrealized assets?

We explain complicated things in simple terms. Read below.

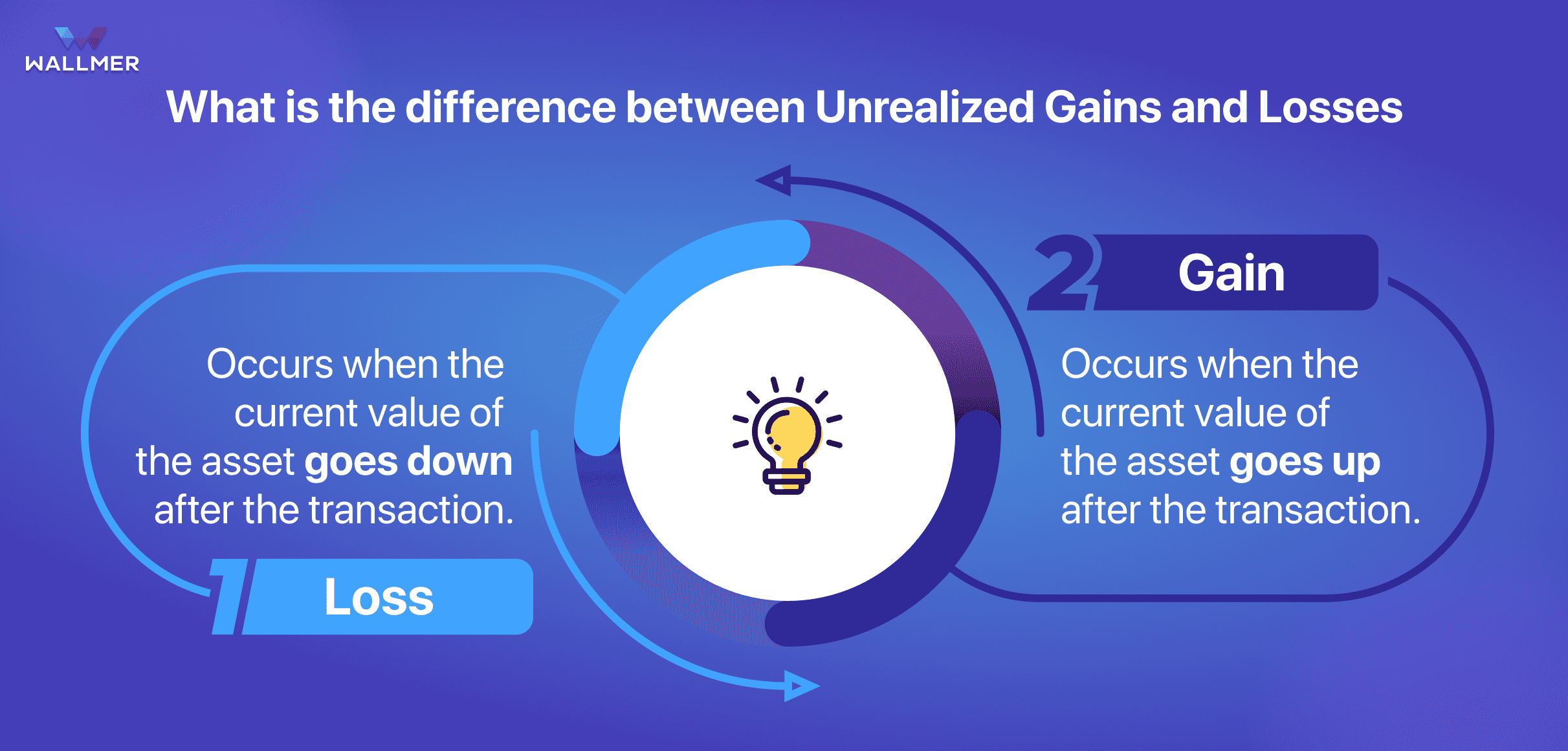

What is the difference between Unrealized Gains and Losses

Before we get to the main part, let’s understand what is gained and what is lost.

If you decide to sell cryptocurrency or buy something using it, you get a realized gain or loss. A similar mechanism works with any type of investment, such as crypto, stocks, etc.

Unrealized gain and loss are a constant phenomenon in the crypto market.

Similar to realized assets, unrealized gain occurs when the value of a cryptocurrency rises above its original purchase, but the owner doesn`t rush to sell the coin. An unrealized loss is when a cryptocurrency decreases in value, but the asset remains in the account. Thus, these are potential funds that you may have earned or lost as a result of the transaction.

Unrealized gains or losses have no effect on the cryptocurrency owner’s wealth until he sells his digital assets.

Investors keep unrealized gains when the value of a cryptocurrency is expected to rise. Once the price reaches a certain point and the crypto asset is sold, the unrealized gain is converted into realized gain.

If there is a solid reason to expect that the price of a coin will fall in value, it is likely to be gotten rid of.

How to calculate Unrealized Gains ⬆️

Let’s imagine that somewhere lives a forward-thinking girl named Amanda, who decides to invest in cryptocurrency.

Amanda registered on the most famous exchange, opened a safe wallet, and bought 0.5 BTC for $9,500. A few days later, the value of Bitcoin increased by $2,000. But she didn`t sell her asset. In this way, Amanda had an unrealized gain of $2,000.

In the long run, she could sell her 0.5 BTC and make a gain, i.e., sell it.

Example of unrealized losses ⬇️

Let’s take another situation, where the main character is an experienced crypto investor, named Mason.

For a long time, the man was hesitant to invest in Bitcoin. But in November 2021, Mason purchased 1 BTC for $60,000. In June 2022, when the value of Bitcoin fell to $19,000. So he suffered an unrealized loss of $41,000.

Nevertheless, Mason is not in a rush to sell his crypto asset, because he believes that the price of Bitcoin is going to rise.

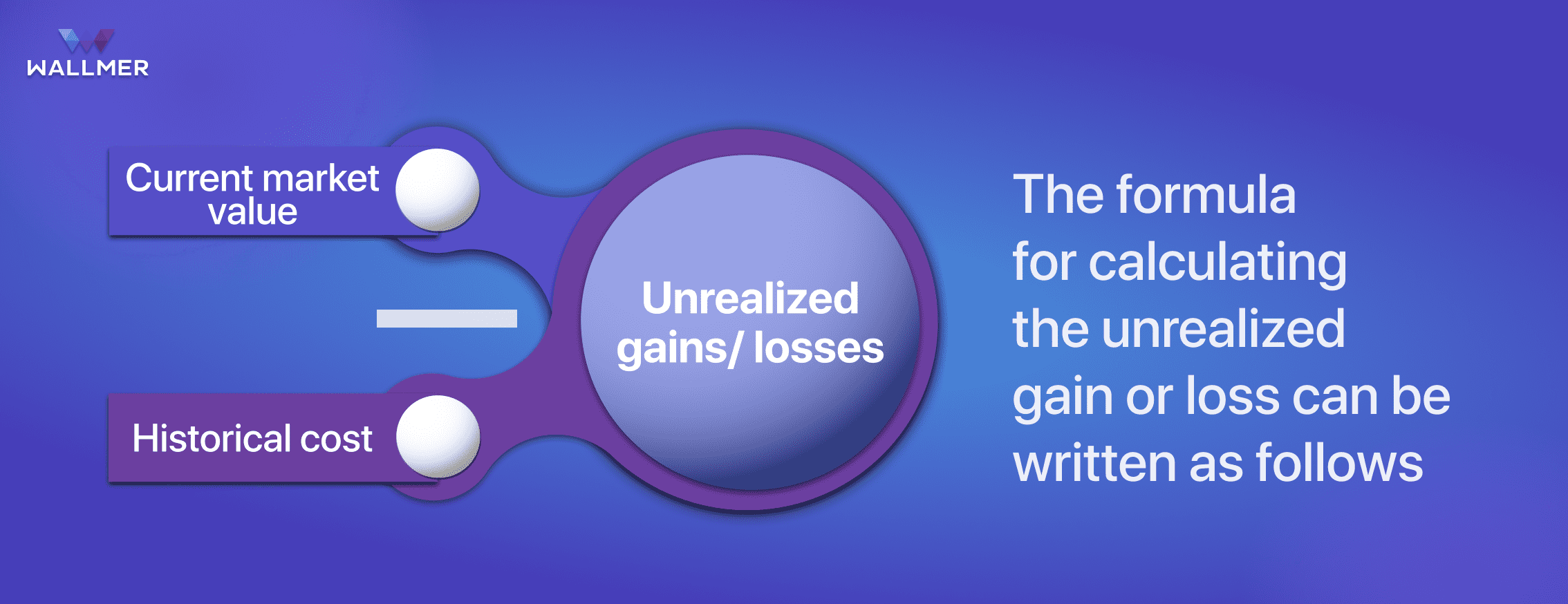

The formula for calculating the unrealized gain or loss can be written as follows:

Why is it important to track unrealized gains and losses?

If unrealized gains or losses have no effect on the financial condition, then there is no need to keep track of them? That’s what beginners in the crypto world might think. But experienced investors know that the analysis of the gains and losses allows getting profit.

Tracking unrealized gains and losses helps you monitor price fluctuations in the market.

This way, the user can set clear goals for both unrealized gains and unrealized losses. This helps to minimize the risk of losing investment. Although, it never completely eliminates it!

Exchanges and services offer a monitoring system to get strategic information about investments.

Is Unrealized Gain or Loss Taxed?

When income is realized on a gain, it is subject to mandatory tax. Any capital gains must be reported in your tax return. The amount that is charged in capital gains tax depends on where you live and for how long you have owned your asset.

❓What about unrealized gains❓

Here you can breathe a sigh of relief.

Unrealized gains or income are not taxable.

First, this is because such income is only potential, so there are no tax consequences. This rule applies until you decide to sell, exchange, or cash out your asset.

How to legally avoid taxes on cryptocurrency in 2022, read in our article.

Summary

Any physical transaction with cryptocurrency implies its gain or loss. Realized gains are taxable depending on the country where you live. A realized loss allows investors to take a deduction from their taxable income.

Unrealized gains or losses aren`t reported on tax returns because they are not physical assets. Many crypto investors prefer to keep frozen funds to avoid paying taxes.